Introduction:

Intraday trading, also known as day trading, is a popular and exciting approach in the stock market. It involves buying and selling financial instruments within the same trading day, aiming to profit from short-term price fluctuations. Successful intraday trading requires a combination of knowledge, skill, discipline, and the ability to adapt quickly to market conditions. In this blog, we will explore some strategies and tips to help you navigate the world of intraday trading and increase your chances of success.

1. Educate Yourself:

Before diving into intraday trading, it is crucial to have a solid understanding of the stock market and its dynamics. Familiarize yourself with fundamental and technical analysis, learn how to read stock charts, and stay updated on relevant news and economic indicators. Continuous learning is essential to adapt to evolving market trends and make informed trading decisions.

2. Develop a Trading Plan:

A well-defined trading plan is the foundation for successful intraday trading. Determine your risk tolerance, set clear profit targets, and establish stop-loss levels to protect yourself from significant losses. Your plan should include entry and exit strategies, position sizing, and specific criteria for selecting stocks. Stick to your plan and avoid impulsive decisions driven by emotions.

3. Focus on Liquid Stocks:

Liquidity is vital in intraday trading. Trade stocks with high trading volumes and tight bid-ask spread to ensure easy entry and exit. Liquid stocks tend to have less slippage, reducing the impact of transaction costs on your profits. Conduct thorough research and create a watchlist of liquid stocks that fit your trading criteria.

4. Technical Analysis:

Utilize technical analysis tools to identify short-term trends, support and resistance levels, and potential entry and exit points. Popular technical indicators such as moving averages, MACD, and RSI can help you gauge momentum and identify overbought or oversold conditions. Combine multiple indicators and patterns to increase the reliability of your signals.

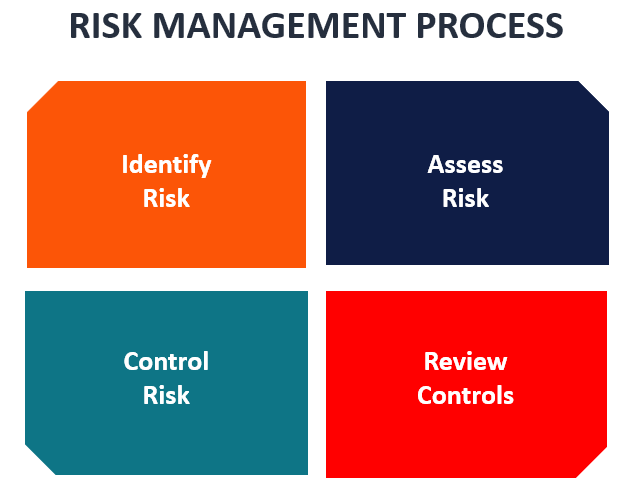

5. Risk Management:

Managing risk is crucial in intraday trading. Never risk more than a predetermined percentage of your trading capital on any single trade. Use stop-loss orders to limit potential losses and trailing stops to protect profits. Maintain a favorable risk-to-reward ratio by setting realistic profit targets based on market conditions.

6. Time Management:

Intraday trading requires focused attention and quick decision-making. Set aside dedicated time for trading and avoid distractions. Identify the most active trading hours and concentrate your efforts during those times. Avoid overtrading, as it can lead to emotional exhaustion and poor decision-making. Quality trades over quantity is the key.

7. Keep Emotions in Check:

Emotions can cloud judgment and lead to impulsive trading decisions. Stick to your trading plan and avoid making decisions based on fear or greed. Maintain discipline and do not chase after losses. Learn from your mistakes and stay objective in your analysis and execution.

8. Paper Trading and Backtesting:

Practice and refine your trading strategies through paper trading or using virtual trading platforms. Simulated trading allows you to test your ideas, gain experience, and fine-tune your approach without risking real money. Additionally, backtest your strategies using historical data to assess their effectiveness in different market conditions.

___________________________________________________________________________________

Intraday trading offers immense potential for profit, but it comes with its share of risks. By educating yourself, developing a trading plan, focusing on liquid stocks, utilizing technical analysis, managing risk, practicing effective time management, and maintaining emotional discipline, you can increase your chances of success in the fast-paced world of intraday trading. Remember, consistent profitability requires continuous learning, adaptability, and discipline. Happy trading!

Comments

Post a Comment